Dreaming of a lie-flat bed over the Atlantic without the five-figure price tag? In 2026, American Airlines is rolling out even more “Flagship Suite” seats featuring privacy doors. However, finding these seats for miles requires more than just luck.

Are you willing to be flexible, or maybe settle for just a flatbed in an older business product or premium economy instead? Flexibility is the main key to searching for premium seats on American Airlines.

Here are some other tips to find awards with AA:

1. Master the Partner “Sweet Spots.”

The secret to the best value often lies with AA’s Oneworld partners. While AA-operated flights can fluctuate in price, partner awards are often more stable than other alliance partnerships, but taxes and fees can be the enemy with partners.

Finnair to Helsinki (HEL): Finnair has expanded award availability in recent years, especially from hubs like Dallas (DFW). Their “AirLounge” business class is famous for its unique non-reclining (but fully flat) design. In the past, there have been times with a lot of inaccurate or ‘phantom’ space during award searches with Finnair, however.

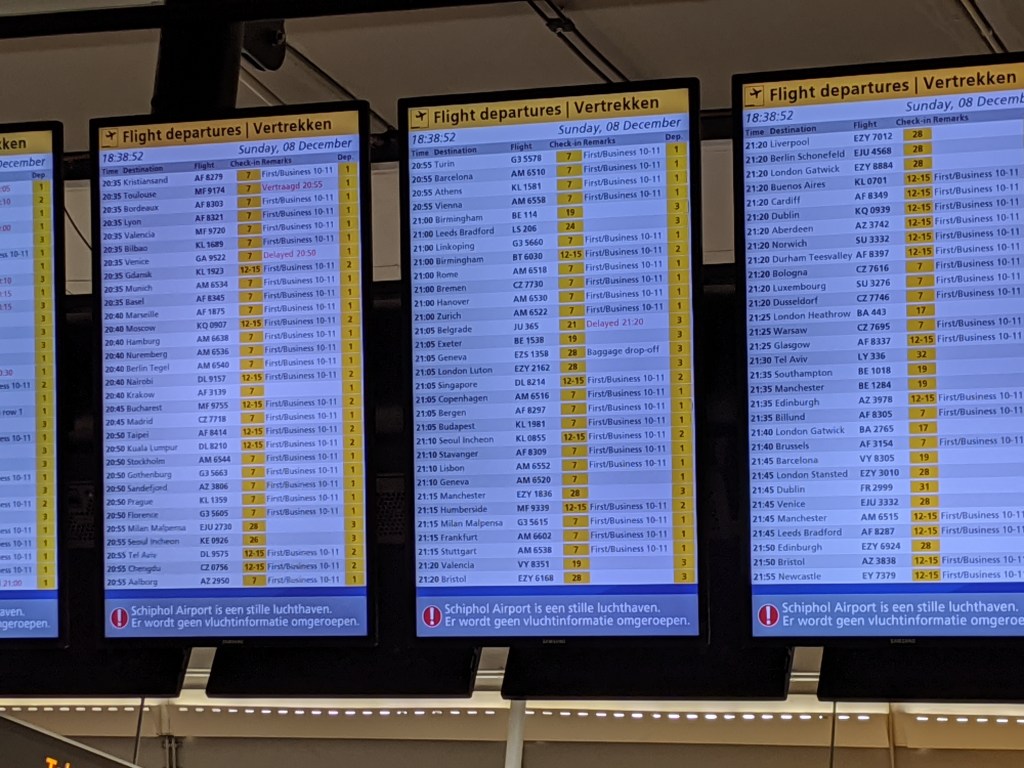

Iberia to Madrid (MAD): If you want to avoid up to $750+ surcharges typical of British Airways, Iberia is your best friend. Expect taxes closer to $120.

AA Metal to Secondary Hubs: Instead of London (LHR), search for AA-operated flights to Munich (MUC), Milan (MXP), or Zurich (ZRH). These often have better “Saver” availability than the ultra-competitive New York-to-London routes.

2. Use Advanced Search Tools

Don’t just rely on the standard search bar. Professional “point-hackers” use other tools:

- Seats.aero: The fastest way to see a massive “map” of availability across multiple dates and routes at once. Paid site.

- ExpertFlyer: Essential for setting “Award Alerts.” If the seat isn’t available today, ExpertFlyer will email you the second it opens up. Paid site.

- AA.com Calendar: If you prefer the official site, always use the Advanced Search and check the “Redeem Miles” box to view the 30-day award calendar. Searching one way at a time can be helpful as well. Free.

3. Avoid the “London Tax.”

When flying home from Europe, try to avoid departing from London if you can avoid it. The UK’s Air Passenger Duty (APD) can add hundreds of dollars to a “free” ticket. It is higher for premium cabins than for economy. Instead, start your return journey from Dublin (DUB), Madrid (MAD), or Amsterdam (AMS) to keep your out-of-pocket costs to a minimum.

Even cities like Paris can have high departure taxes. Taking cheap low-cost carriers (LCC’s) to other cities in Europe to position yourself for a return will save money. Another tip is to take the Eurostar to AMS. While not free, it can pay for itself.

Another savings tip when flying from Europe to the USA is that most flights are daytime flights, so can you get by in economy or maybe premium economy and save?

4. The 331-Day Rule

American Airlines typically opens its booking window 331 days in advance. If you have a specific high-demand date in mind, mark your calendar for exactly 331 days prior to departure to snag “Saver” level seats the moment they are released. But still try to be flexible with that date. Keep in mind that not all inventory is released 331 days out, but what is available does become bookable at that point in time. Partner space may vary more by date.

5. Last-Minute “T-14” Openings

If you didn’t book a year out, don’t panic. Many airlines, including AA partners, release unsold business class seats as awards within 14 days of departure. If you can be flexible, some of the best luxury cabins can be booked just days before you fly. It’s more of a gamble, but if you are also flexible on where you go, it can open up some good opportunities.

Pro Tip: Remember that AAdvantage miles don’t always have change or cancellation fees for award tickets, making it safer in some cases to “lock in” a flight now and change it later if a better route opens up! AA will also let you ‘hold’ an award booking for 24 hours at no cost if the flight you are looking at is 7 or more days away.

6. Seasonal Routes

I used to have more luck with these, but lesser-known American Airlines seasonal routes can offer award availability at times. Often these are seasonal flights from U.S. hubs to smaller European cities like Prague, Budapest, and Milan, as well as routes operated by partners like Finnair.

Philadelphia (PHL) to Prague (PRG) or Budapest (BUD) – Summer.

Dallas/Fort Worth (DFW) to Zurich (ZRH) or Athens (ATH)- May through August.

Philadelphia (PHL) to Glasgow (GLA)- May through September.

Smaller cities like Munich (MUC) or Milan (MXP): Flights from AA hubs like Charlotte (CLT) or Chicago (ORD) to these cities on AA “metal” (AA-operated aircraft) often have more “saver” availability than London routes and help avoid high UK taxes.

7. Search by Segment

Search by Segment: Sometimes, searching for award space for the individual segments of a trip (e.g., PHL-MUC, then MUC-final destination on a partner) can uncover options that don’t appear when searching for the entire itinerary at once. However, keep in mind that ‘married segment’ logic may be required for saver-level awards from certain cities. In addition, just because you can find PHL-MUC and MUC-FCO doesn’t mean you’ll find PHL-FCO with MUC as a layover. In fact, even if you call in, the CSR may not be able to book that.

The other thing that you may find is that the award ticket is 60,000 miles PHL-MUC and 30,000 for PHL-FCO, but book it as one ticket, it may be 275,000 due to segment logic rules and availability.

The opposite can work in your favor, however. For example, you may find an award from ORD for 300,000 miles, but starting in STL, it may drop to 100,000, due to ‘married segment logic’.

Set your Expectations Accordingly

Many times, you may find a decent-priced premium award ticket, but most often that lower price will include things people don’t like. For example, you may have to connect LGA-JFK in New York, or you might end up with a 15-hour layover. If you don’t mind that 5:15am flight, it can be cheaper even for domestic awards. To save money, you might need to put up with a less-than-desirable route or itinerary. To me, it’s part of the adventure.

One last thing I would mention is that if you book a flight 11 months out, there is a VERY good chance the flight and/or the aircraft will change during that time. Sometimes AA will rebook you, and it’s fine, but many times you’ll have to call in to get it adjusted to your liking. This can be in your favor as you might be able to have them move you to another, better flight. But keep an eye on your reservation. If you are forced to call in, it’s a good idea to search for alternate routes for your trip before you call. Look at any award ticket, regardless of the mile price, and during the conversation, nicely offer them what you found. Don’t get upset if they can’t book it the way you want, though. This is especially true with partner awards.