My wife has the Southwest Priority Card until the annual fee goes up next year. She just got a spend promo from Chase. These are pretty typical and usually provide 5x points for spend in certain categories. We always sign up for them, but usually can’t max them out unless it’s something good like Amazon spending. I guess you could say I am pretty well-versed on these and the fine print.

We currently have several cards with gas, grocery, and restaurant deals from 3x to 5x, but this new Southwest one caught my eye.

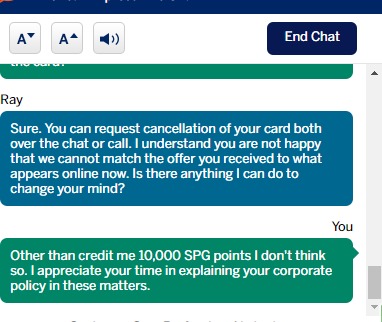

As you can see, it is 4% up to $40 through September. I thought, well, that is pretty good and easy to max out, even if we buy most of our groceries at Walmart, which doesn’t count. But then I read the fine print.

OK, still 4% back up to $40, so doing my public school math, that is $1,000 to get $40, I’m in, or at least I’ll register. But then it dawned on me…why? Why cashback, why not points or miles? Now I know Freedom does this as cash back, but it really ends up being points.

Maybe I’m dumb, but since we prefer airline credit cards, wouldn’t you think Chase would assume we want miles or points instead of cash? If I just wanted a cash rewards card, I’d just do that. I’m sure I’m reading too much into all this, but it will be interesting to see how we earn this bonus. Of course, it takes 6 to 8 weeks because, well, it’s 2025.

My conclusion on this is if they want to pay us 4% cash back instead of the typical 5x points, does that mean Southwest points are worth less than 1 cent each? My reasoning is that if this were 5x points, I’d earn 5,000 points, not $40 for the same $1,000 spend on this card.

If my math is correct, 5,000 points at $40 is about .008 per point.

Next time, Chase, just give me points, it’s a game, not real life, to me in this space. I’m trying to earn a vacation here, not $40.

I’d even add that if I had $40 in Southwest points, which we now know is 5,000 points, I’d be spending them only on Southwest, so the cost for them to provide that 5,000 worth of service would likely be worth less and give them more profit. I suppose Chase doesn’t see it that way.