So I was reading the Travel with Grant blog today and he states how he is in a funk over hotel programs. I agree and attempted to give my 5 cents. Why because it’s free. Not I’m not a troll on Boardingarea. Well maybe I’m sort of a big fan that is opinionated.

So I share some thoughts on most hotel programs below. Keep in mind that I travel 100 to 125 nights a year on business plus vacations and cruises so yes my dogs hate me. My wife travels 75 to 100 nights as well. She is a real IHG Spire loyalist as am I and am a Spire Ambassador (sounds impressive) but I also branch out with Hilton and Marriott a lot. We both hold Silver status with Marriott and I have Diamond with Hilton as well as Gold with Radisson.

Radisson used to be better but 40k a year is worth keeping the card for an odd night or so plus Gold status. I love Radisson Blu hotels and have stayed at a lot of them all over the world.

Hyatt, I love love them but…not enough properties. So I don’t want to waste my stays there.

Marriott, I want to love them, they have properties everywhere, but it’s too hard to earn top tier status. But…once you do you can earn United Silver. But…the free night certs are limited and expire too quickly. I’ve got about a dozen stays in with them this year so far but as a Silver i wonder why I’m not at other chains where my status is higher.

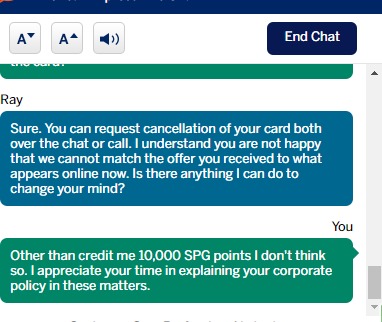

SPG, you should have already moved your points over to Virgin to Alaska when you had the chance. They also have too many places where the hotel selection it too eclectic and it’s not my thing. Points super valuable but a bit hard to rack up quickly in my world.

IHG, I love IHG. They have properties everywhere, well they are weak in Hawaii (come on IHG). As an IHG credit card holder you get a real free night cert that you can use for a year. In addition they have good promos. I also like buying up in points or cash to Intercontinental status for the free night rebates or status share and free weekend BOGO cert although it’s not always the best deal. The IHG card also gives you Platinum status which is a nicer level than some others.

Choice Hotels. They have been going down hill for years. The Cambria properties offer some hope and I really like them but they don’t have Cambria hotels in most areas. In general they are a fancy Wyndham motel or an Ex-IHG,Marriott,Hilton property. The card is OK I guess but I’m not a fan in general.

Wyndham…..They have lied to me many times on promotions and have for years. They have a few good properties but unless you work on a transient labor crew and are forced to “do time” in Super 8’s or HOJO’s then they are not a good place to be, trust me.

Best Western. They are like an honest Wyndham with slightly better rooms or maybe equal with Choice. The future is bright for them as they seem to be putting in a real effort to improve the hotels but unless you do business travel in a region where they are all over it’s not my first, second or third choice and I’m Diamond with them (don’t ask).

Hilton. You’ll notice they are lumped at the bottom. If it wasn’t for nicer hotels they would be even with Choice or Best Western. They have devalued SO much I’m not sure where the bottom is. I want to love Hilton but they don’t love me back. The Hampton’s are a weak HIX and they devalue faster than I can earn points and I’m a Hilton Diamond. Sure they offer free breakfast and free wifi but isn’t that like free HBO and air conditioned rooms? They also did away with the double dip in another devaluation. 2017 may have seen some of my last stays with Hilton as I watch my Hilton points currency burning in front me faster than I use it. It’s like the Wiemar Republic of the hotel points world. Maybe I’ll start referring to their points as HHonormarks or RReichmarks.

So bottom line is use the cards from the random hotel chains for the perks and odd location awards but Marriott or IHG should be your future until they follow Hilton to the Neverland Ranch. The dynamics change for certain types of travelers I know and I don’t think everyone will agree with me. Just my personal opinion based on my experience and how I’ve been treated by these programs over the years. Plus I’m biased. Now IHG go build some Hawaii properties so I can go there on vacation already 🙂

My advices is to put most of your day to day spend on a good card like Chase Sapphire Reserve and forget doing much spending on hotel cards unless you need the hit to earn a promo, etc. Churn these cards to get points unless your a business traveler and if you are pick the best one that works for you everywhere you go or want awards.

Notice I have no affiliate links in my post so I’m trying to be as honest as I can about my feelings on these properties but keep in mind that I’m a bit biased to IHG in general.